https://sputnikglobe.com/20231029/why-eus-plan-to-use-russias-frozen-assets-for-aiding-ukraine-is-wishful-thinking-1114577988.html

Why EU's Plan to Use Russia's Frozen Assets for Aiding Ukraine is Wishful Thinking

Why EU's Plan to Use Russia's Frozen Assets for Aiding Ukraine is Wishful Thinking

Sputnik International

EU leaders want to use profits emanating from frozen Russian state assets for Ukraine reconstruction and have urged the European Commission to consider a legal framework for this, per the Western mainstream press. Is that really possible?

2023-10-29T15:00+0000

2023-10-29T15:00+0000

2023-10-29T16:49+0000

world

europe

european union (eu)

russia

ukraine

brussels

european commission

ursula von der leyen

business

jacques sapir

https://cdn1.img.sputnikglobe.com/img/07e7/0a/06/1113983095_0:159:3077:1889_1920x0_80_0_0_37314de3a3f6a0c067bb54d142164cdd.jpg

The value of frozen Russian sovereign assets in Europe is estimated at 211 billion euros ($223 billion). Brussels has repeatedly hinted that it would tap into these assets for the benefit of Ukraine. Still, the bloc has so far not invented a legal mechanism for laying its hands on Russia's property.Meanwhile, European Commission President Ursula von der Leyen stated on Friday that Brussels is working on a proposal to use profits generated by Russia's assets to help the Kiev regime. She claimed that EU finance ministers had made good progress on the matter earlier this month. "So the next step would be then an actual proposal," von der Leyen said.Per the EC president, the initial focus will be on windfall profits from the frozen Russian state assets. "Windfall profit" is defined as an unusually high income caused by unexpected market factors. EU economists suggest that Ukraine may get as much as three billion euros from Russia's assets annually.However, experts interviewed by Sputnik say this is nothing but wishful thinking.To complicate matters further, the attempt to seize either Russian state assets or revenues generated by these assets puts the EU in a very tricky legal position, according to Jacques Sapir, director of studies at the School for Advanced Studies in the Social Sciences (EHESS) in Paris.Under What Circumstances Could EU Seize Russia's Assets?To create a legal framework for grabbing Russia public assets, the EU needs to declare nothing short of war against the Russian Federation, which the bloc wouldn't do, according to Sapir. Similarly, when it comes to Russia's private assets, the owners should be legally convicted by EU member states."Nevertheless, if a legal action is taken by the owner (be it private or be it the Russian state) to recover the money against the given state, any country helping it to seize the money and of course the country benefiting from it are to be said accomplice in a legal procedure. And procedures there will be," the French economist stressed.Per Golubovsky, the EU may try to "borrow" Russia's profits. For instance, Brussels could hypothetically take this money in the form of a "special loan from the depository in Euroclear and Clearstream where they are now stored. After that, this money would go into the budget of the European Union, "from which they can send money anywhere, including for helping Ukraine," he explained.If the EU tries to use Russia's assets for the bloc's needs, one would be able to track this money, since the European budget is not classified, according to Golubovsky. In this case, again, Russia would be able to challenge the legality of using these assets. All in all, both experts doubt that the EU would be capable of getting away with grabbing Russia's money.Could Russia's Frozen Assets Meet Fate of Gaddafi's Funds?Meanwhile, some observers refer to the case of profits generated by Libyan leader Muammar Gaddafi's frozen funds, which vanish into the pockets of some unknown beneficiaries. In 2018, a Politico investigation discovered regular outflows of stock dividends, bond income, and interest payments from 16 billion euros of the Libyan leader's assets held in Belgium.However, Sputnik's interlocutors brushed away concerns that Russia's assets may face a similarly murky fate."First, the seizure of LIA assets followed the crumbling of Gaddafi's regime and the crumbling of the state. By the way, some countries have gone so far that a 'de facto' war situation existed between them and the LIA," said Sapir."Second, as it was in your example Gaddafi’s personal money, and Gaddafi used a lot of very special procedures, not transparent and accountable at all. When he died, his own family would have been hard pressed to push its ownership rights. That is what allowed these funds (we could here speak of 'reptile funds') to be taken by 'unknown' beneficiaries. As far as Russian assets are concerned, be they private or public, there is much more transparency and accountability," continued the French economist.Per Golubovsky, Russia's public and private assets aren't mired in controversy and private Russian investors and brokerage houses theoretically have the opportunity to sue the European Court to demand the unfreezing of their assets if they prove that they are not under sanctions and are not related to persons who are under sanctions, and that the money which they demand be unfrozen has no relation to Russia’s special operation in Ukraine.How Could EU's Attempt to Seize Russia's Assets Backfire on Bloc?"If the EU implements what could be called a 'legal theft', the EU’s financial reputation would be ruined among non-Western countries. I don’t see investors from the Gulf States or from India or China to be very comfortable with this situation," emphasized Sapir.For his part, Golubovsky has drawn attention to the fact that Switzerland nipped the idea of seizing Russia's assets in the bud. Even though Switzerland has frozen assets of sanctioned Russians worth $8 billion, the Swiss government stipulated that the confiscation of frozen Russian assets would be contrary to the constitution and the current legal order.If the European Union wants to save its reputation, it should halt discussions with regard to grabbing Russia's assets, according to the Russian expert.Meanwhile, Russian political commentators say that if the EU resorts to "stealing" Russia's frozen assets, Moscow could move to confiscate assets belonging to European Union states it deems unfriendly.

https://sputnikglobe.com/20231014/legal-theft-us-intensifies-push-to-give-ukraine-300-billion-of-frozen-russian-assets-1114173746.html

https://sputnikglobe.com/20190701/gaddafi-frozen-assets-uk-1076116509.html

https://sputnikglobe.com/20231026/eu-leaders-to-discuss-russias-frozen-assets-further-support-for-ukraine---eus-michel-1114502200.html

https://sputnikglobe.com/20230513/ukraine-cant-have-russian-assets-frozen-in-switzerland-bern-says-1110323614.html

https://sputnikglobe.com/20230621/long-costly-legal-battle-awaits-attempt-to-seize-frozen-russian-assets-for-ukraine-reconstruction-1111370843.html

russia

ukraine

brussels

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

russian frozen assets, russian special military operation in ukraine, can eu use frozen russian assets to aid ukraine, legal framework for seizing russia frozen assets, could ukraine get russia frozen assets, russia's public assets frozen in eu, russian private assets frozen in eu, ursula von der leyen, profits generated by russian frozen assets, could eu use windfall profits generated by russian frozen assets

russian frozen assets, russian special military operation in ukraine, can eu use frozen russian assets to aid ukraine, legal framework for seizing russia frozen assets, could ukraine get russia frozen assets, russia's public assets frozen in eu, russian private assets frozen in eu, ursula von der leyen, profits generated by russian frozen assets, could eu use windfall profits generated by russian frozen assets

Why EU's Plan to Use Russia's Frozen Assets for Aiding Ukraine is Wishful Thinking

15:00 GMT 29.10.2023 (Updated: 16:49 GMT 29.10.2023) EU leaders want to use profits emanating from frozen Russian state assets for Ukraine reconstruction and have urged the European Commission to consider a legal framework for this, per the Western mainstream press. Is that really possible?

The value of frozen Russian sovereign assets in Europe is estimated at 211 billion euros ($223 billion). Brussels has repeatedly hinted that it would tap into these assets for the benefit of Ukraine. Still, the bloc has so far not invented a legal mechanism for laying its hands on Russia's property.

Meanwhile, European Commission President Ursula von der Leyen stated on Friday that Brussels is working on a proposal

to use profits generated by Russia's assets to help the Kiev regime. She claimed that EU finance ministers

had made good progress on the matter earlier this month. "So the next step would be then an actual proposal," von der Leyen said.

Per the EC president, the initial focus will be on windfall profits from the frozen Russian state assets. "Windfall profit" is defined as an unusually high income caused by unexpected market factors. EU economists suggest that Ukraine may get as much as three billion euros from Russia's assets annually.

However, experts interviewed by Sputnik say this is nothing but wishful thinking.

"Using profits from frozen assets in the form of seizing these profits is just as impossible as seizing these assets," Dmitry Golubovsky, analyst for the Russian company Zolotoi Monetnyi Dom [lit. Golden Coin House], told Sputnik. "It would be a sheer violation of property rights. In my opinion, there are no legal mechanisms in the EU system to do this. The situation is further complicated by the fact that the assets frozen in Euroclear and Clearstream may concern different jurisdictions. For example, some structural products, which consist of bonds of European and non-European countries, may be frozen there. So this whole story is extremely confusing and, from a legal point of view, looks insoluble."

To complicate matters further, the attempt to seize either Russian state assets or revenues generated by these assets puts the EU in a very tricky legal position, according to Jacques Sapir, director of studies at the School for Advanced Studies in the Social Sciences (EHESS) in Paris.

"As a matter of fact, if assets belong to the Russian state legally, you will have to prove that this state is a 'failing state,' something impossible," Sapir told Sputnik. "If assets belong to private persons, you need a legal conviction against these persons. If you can’t do both and that you take away revenues to divert them to a third party (Ukraine) this is no less than a theft. Then you will be liable to a legal action. But, what is even more important, you will probably discourage all foreign investors to invest in the EU."

14 October 2023, 04:10 GMT

Under What Circumstances Could EU Seize Russia's Assets?

To create a legal framework for grabbing Russia public assets, the EU needs to declare nothing short of war against the Russian Federation, which the bloc wouldn't do, according to Sapir. Similarly, when it comes to Russia's private assets, the owners should be legally convicted by EU member states.

"Technically if this is done (and it will not be), the money will have to go to EU member states (as it is when we are talking about drug trafficking money), and then each state could make the decision to give this money to Ukraine. But one thing is at least clear. If money, will it come from revenues or from assets, is to be seized, it would be under the framework of a legal case of a given country against the owner. So, the money is to go to the given state first. After that, it will be free to give it to Ukraine," explained Sapir.

"Nevertheless, if a legal action is taken by the owner (be it private or be it the Russian state) to recover the money against the given state, any country helping it to seize the money and of course the country benefiting from it are to be said accomplice in a legal procedure. And procedures there will be," the French economist stressed.

Per Golubovsky, the EU may try to "borrow" Russia's profits. For instance, Brussels could hypothetically take this money in the form of a "special loan from the depository in Euroclear and Clearstream where they are now stored. After that, this money would go into the budget of the European Union, "from which they can send money anywhere, including for helping Ukraine," he explained.

"It would be obviously possible to track this money if they were used as part of the EU budget expenditures," Golubovsky continued. "Once they get to Ukraine, it would naturally be impossible to track them, because everything that gets into Ukraine is impossible to track. The Pentagon has already faced this problem when it failed to explain where the aid allocated to Ukraine had actually gone and could not even report on how the weapons transferred by Ukraine were used. Now information is emerging that weapons transferred to Ukraine are surfacing, for example, in the Middle East and ending up in the hands of various groups, including those currently waging war with Israel."

If the EU tries to use Russia's assets for the bloc's needs, one would be able to track this money, since the European budget is not classified, according to Golubovsky. In this case, again, Russia would be able to challenge the legality of using these assets. All in all, both experts doubt that the EU would be capable of getting away with grabbing Russia's money.

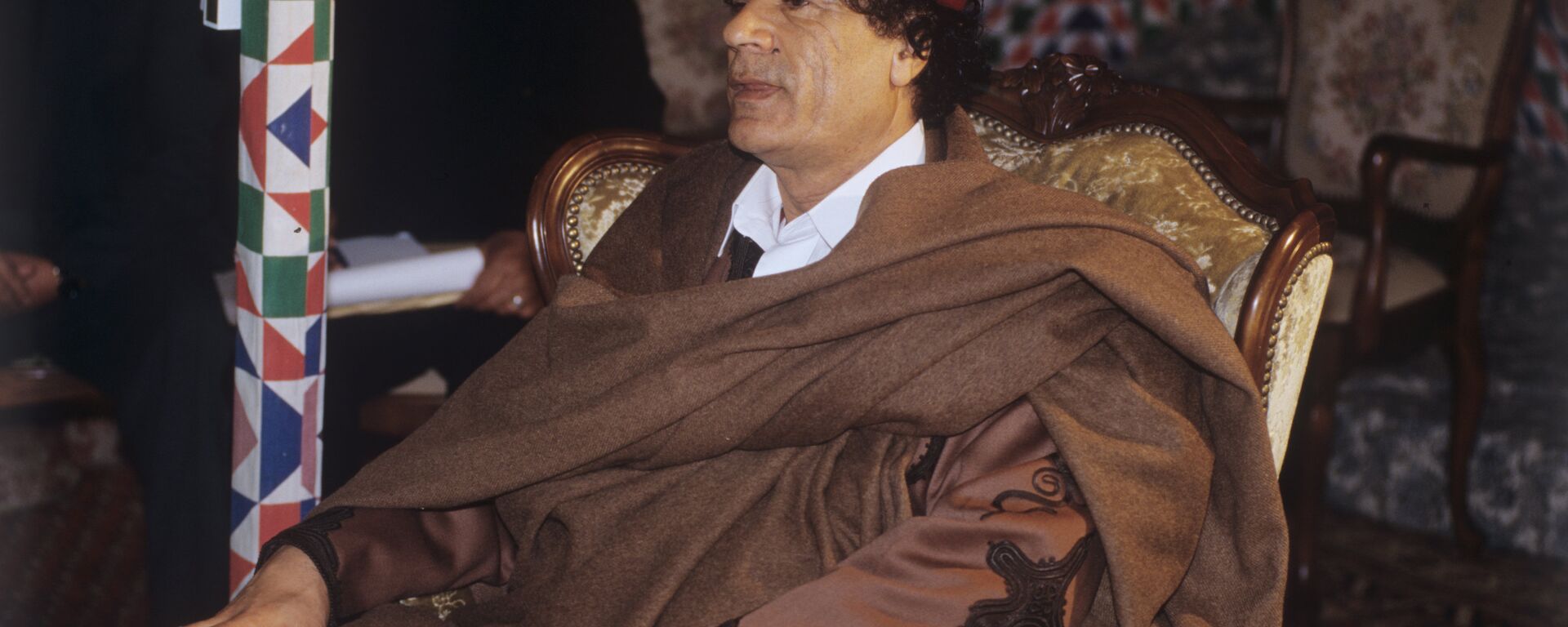

Could Russia's Frozen Assets Meet Fate of Gaddafi's Funds?

Meanwhile, some observers refer to the case of profits generated by Libyan leader Muammar Gaddafi's frozen funds, which vanish into the pockets of some unknown beneficiaries. In 2018, a Politico investigation discovered regular outflows of stock dividends, bond income, and interest payments from 16 billion euros of the Libyan leader's assets held in Belgium.

Even though the Belgian Finance Ministry told the media that the money goes to the Libyan Investment Authority (LIA), the country’s sovereign fund, managed by Euroclear, a financial institution headquartered in Brussels, it is unclear who exactly has access to the assets, given that Libya has remained war-torn since 2011.

However, Sputnik's interlocutors brushed away concerns that Russia's assets may face a similarly murky fate.

"First, the seizure of LIA assets followed the crumbling of Gaddafi's regime and the crumbling of the state. By the way, some countries have gone so far that a 'de facto' war situation existed between them and the LIA," said Sapir.

"Second, as it was in your example Gaddafi’s personal money, and Gaddafi used a lot of very special procedures, not transparent and accountable at all. When he died, his own family would have been hard pressed to push its ownership rights. That is what allowed these funds (we could here speak of 'reptile funds') to be taken by 'unknown' beneficiaries. As far as Russian assets are concerned, be they private or public, there is much more transparency and accountability," continued the French economist.

Per Golubovsky, Russia's public and private assets aren't mired in controversy and private Russian investors and brokerage houses theoretically have the opportunity to sue the European Court to demand the unfreezing of their assets if they prove that they are not under sanctions and are not related to persons who are under sanctions, and that the money which they demand be unfrozen has no relation to Russia’s special operation in Ukraine.

26 October 2023, 13:53 GMT

How Could EU's Attempt to Seize Russia's Assets Backfire on Bloc?

"If the EU implements what could be called a 'legal theft', the EU’s financial reputation would be ruined among non-Western countries. I don’t see investors from the Gulf States or from India or China to be very comfortable with this situation," emphasized Sapir.

For his part, Golubovsky has drawn attention to the fact that Switzerland nipped the idea of seizing Russia's assets in the bud. Even though Switzerland has frozen assets of sanctioned Russians worth $8 billion, the Swiss government stipulated that the confiscation of frozen Russian assets would be contrary to the constitution and the current legal order.

"The main motivation why Switzerland immediately abandoned such actions at the level of the Swiss parliament - where legislators prohibited it - was precisely the desire to preserve reputation," Golubovsky explained.

If the European Union wants to save its reputation, it should halt discussions with regard to grabbing Russia's assets, according to the Russian expert.

Meanwhile, Russian political commentators say that if the EU resorts to "stealing" Russia's frozen assets, Moscow could move to confiscate assets belonging to European Union states it deems unfriendly.

"From the point of view of the European Union, in my opinion, it would be even more prudent to enter into certain negotiations with representatives of the Russian financial authorities on a 'mirror unfreezing' of assets. That is, for a certain amount, for example, the assets of individuals in Europe are blocked; for a certain amount, the assets of non-residents in the Russian Federation are blocked - some exchange may take place," Golubovsky concluded.