Illustration: Chen Xia/GT

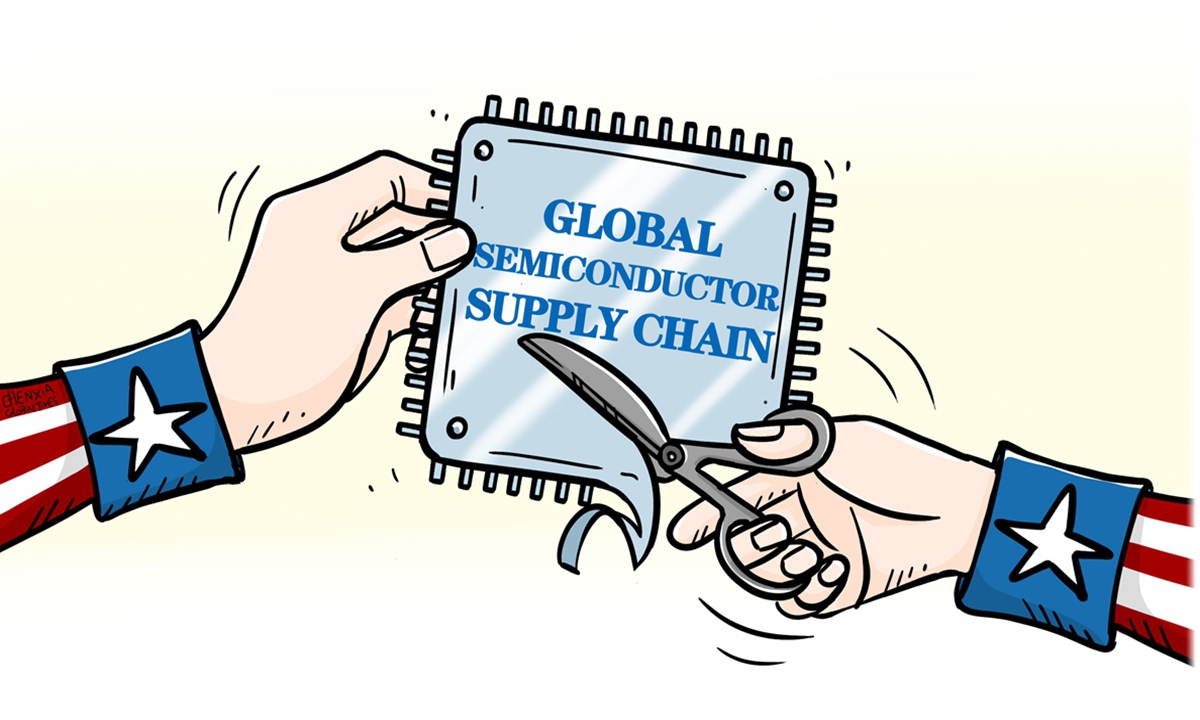

The US Commerce Department on Tuesday announced a plan to curb the sale of more advanced artificial intelligence (AI) chips to China, further intensifying the chip blockade against China and dealing a new blow to US chip businesses that sell to the vast Chinese market.As the world semiconductor industrial chains have already been severely impacted by the US' relentless political interference, Dutch chip equipment maker ASML Holding NV warned that new updates to US export curbs that are designed to block China's access to highly advanced chips will undercut its sales in the Chinese market, Bloomberg reported on Tuesday.

The Europe's most valuable tech firm's concern is well justified and represents common opposition against the US' new chip export curbs of the whole international semiconductor industry which has been severely impacted by the continuous measures linked to the US' chip war.

Washington's export controls announced a year ago triggered a strong backlash from the global semiconductor industry and from Chinese firms. The US' restriction had severely disrupted global supply chain, causing great distress for both American and global chip manufacturing companies.

As the US continues to double down on its chip ban against China and arbitrarily interfere in the global chip industrial chain, it will become tougher for US companies Nvidia and Intel to sell existing products in China - or to introduce new chips to circumvent the rules, which will fuel friction between US chipmakers and the US government, the Wall Street Journal reported on Wednesday.

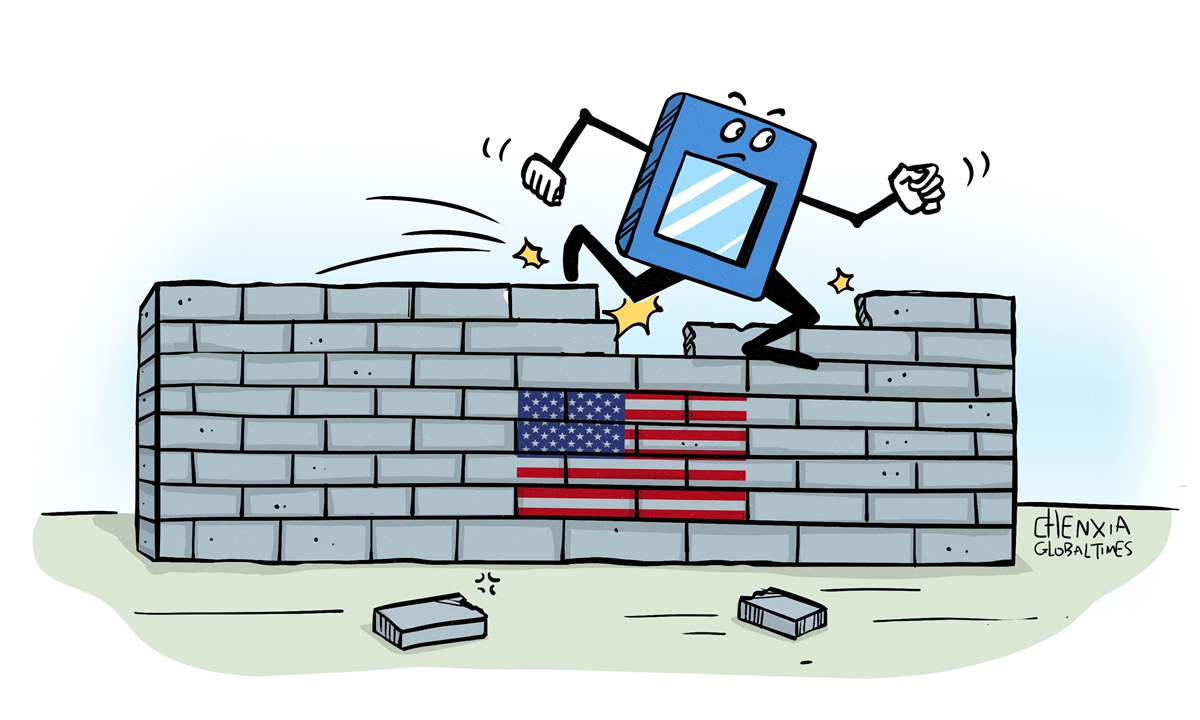

In order to mitigate the impact of the consecutive restrictions in the chip industry imposed by the US, American chip companies have been introducing new chips to circumvent the US' restrictions. For instance, Nvidia modified its flagship A100 and H100 chips to versions that are not prohibited from being sold to China under the US rules.

As the US' new move aims to close perceived "loopholes" in export controls announced a year ago, US chip manufacturers that are already facing difficulties amid reduced demand will find it more challenging to maintain their market share in China, which global chipmakers cannot afford to lose amid weak demand due to factors such as the sluggish economic outlook.

ASML Holding NV's order intake plunged in the third quarter of 2023 amid a sector-wide slump in the semiconductor industry, leaving the company increasingly reliant on revenue from China, according to Bloomberg. ASML's bookings plunged 42 percent last quarter, missing estimates, while China sales accounted for nearly half of revenue in the period, the report said.

For American chip companies, if they further lose market share in China due to US restrictions and decoupling policies, their business will become even more difficult. Just recently, Qualcomm, the world's largest maker of smartphone chips, announced a plan to cut 1,258 positions in the California, as its net income fell to $1.8 billion, a staggering 52 percent year-on-year drop, in the third-quarter.

Chinese Commerce Ministry on Wednesday blasted the US' tightened chip export restriction on China, vowing to take necessary measures to maintain China's legitimate rights and interests.

An increasing number of evidence showed that the US' chip blockade backfires on its own companies, while Chinese chipmakers are making breakthroughs in key technology and their output keeps growing.

US politicians who are concocting the toxic strategies to restrict China's chip development should open their eyes to reality of their counterproductive chip war. This lose-lose tactic not only harms the interests of American companies but also fails to limit China's progress in the chip industry.

The new restrictions will further impact American businesses in the short term and force China to accelerate its independent chip development. This means that some American companies will permanently lose the opportunities they once enjoyed in the Chinese market.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn